send link to app

IRA Tax Differed Accumulation app for iPhone and iPad

4.2 (

6432 ratings )

Business

Finance

Developer: La Salle Software Group Inc.

29.99 USD

Current version: 1.0, last update: 4 years agoFirst release : 30 Nov 2019

App size: 13.57 Mb

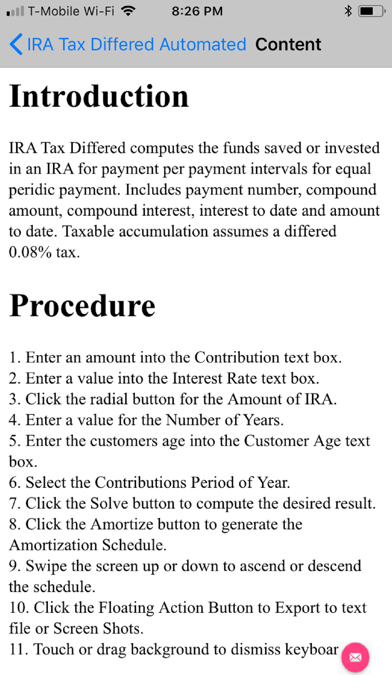

IRA Tax Differed computes the funds saved or invested in an IRA for payment periods or payment intervals for equal periodic payments. IRA Tax Differed includes payment number, compound amount, compound interest, interest to date and amount to date. Tax Differed Accumulations do not

assume a federal tax bracket.